- Lenders across the country are looking for new ways to target Hispanic American homebuyers, a demographic showing significant growth opportunities over the next 20 years. For example:

In 2023, the Hispanic homeownership rate reached 49.5%, with a net gain of 377,000 Hispanic owner-households from the year prior.

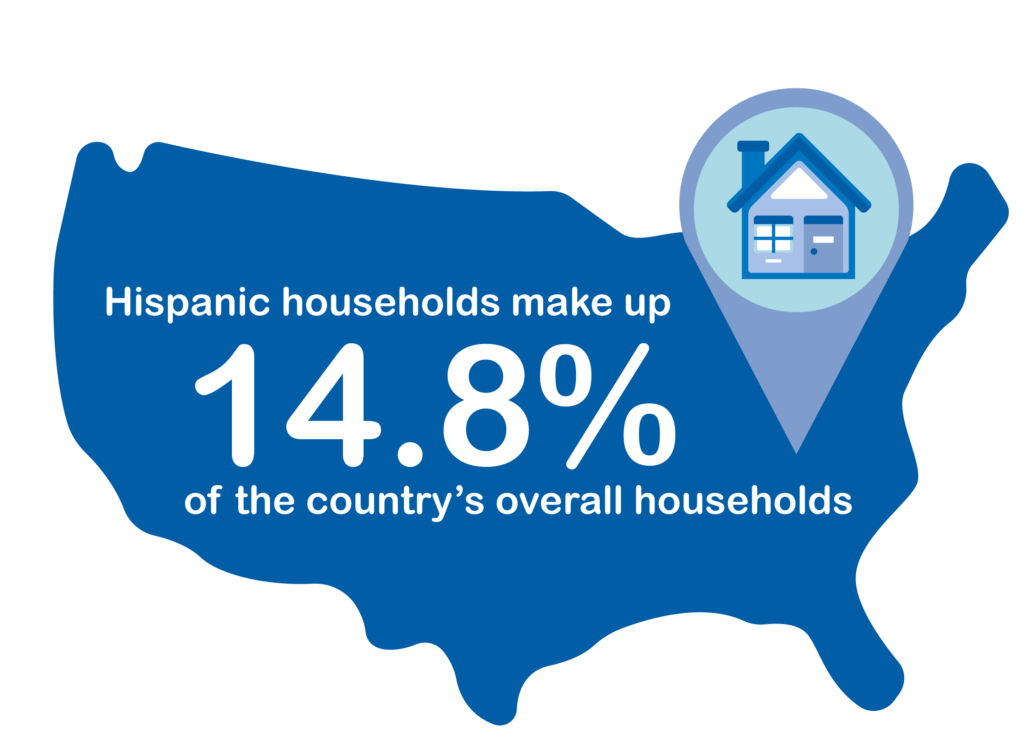

In 2023, the Hispanic homeownership rate reached 49.5%, with a net gain of 377,000 Hispanic owner-households from the year prior.- Over the last ten years, Hispanic households have been responsible for 25.6% of the country’s overall homeownership growth, despite only making up 14.8% of households.

Data about Hispanic American

homebuyer experiences

So, how can your team provide better customer service and improve the homebuying experience for Hispanic Americans? Let’s review some data:

A 2023 Consumer Research Study identified the top three emotions that surveyed Hispanic homebuyers felt about

A 2023 Consumer Research Study identified the top three emotions that surveyed Hispanic homebuyers felt about

their experience:- 48% felt stress

- 44% felt anxiety

- 38% felt frustrated

- According to a 2023 Hispanic Borrower Report:

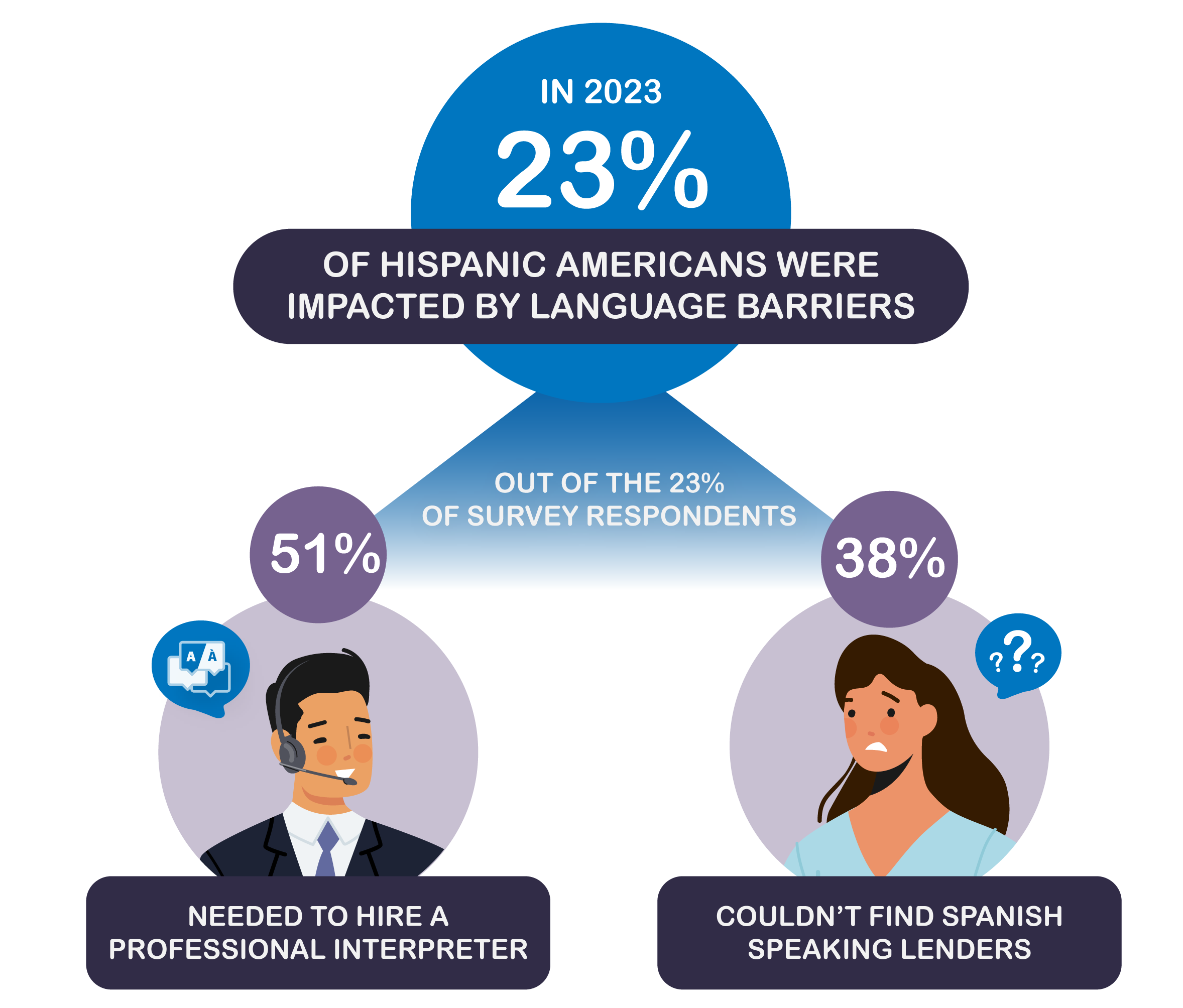

- Many Hispanic Americans aren’t getting the support they need from lenders to feel confident during the homebuying process, with 23% saying language barriers impeded the

mortgage process.- Out of the 23% of survey respondents impacted by language barriers, 51% needed to hire a professional interpreter at an additional cost, and 38% couldn’t find Spanish-speaking lenders in their region.

- Many Hispanic Americans aren’t getting the support they need from lenders to feel confident during the homebuying process, with 23% saying language barriers impeded the

- Hispanic Americans who underwent the application process reported a lack of

available resources.- Only 17% said they received language services from their lender during the application process, resulting in extended timelines.

- For 24% of borrowers, completing the mortgage application took three weeks

or longer.

- Hispanic Americans who underwent the application process reported a lack of

How to use language services to improve Hispanic American homebuyer experiences

Providing language services to homebuyers who speak languages other than English can help your loan officers and staff provide a better customer service and faster, easier-to-follow processes compared to your competitors. In addition, high-quality interpretation and translation can help you:

- Simplify the loan application process to reduce stress, anxiety, and frustration caused by language barriers for both your staff and homebuyers.

- Communicate loan terms and conditions to limited-English proficient (LEP) clients without needing to hire bilingual employees.

- Navigate Dodd-Frank Act requirements and avoid perceptions of Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) when working with clients that speak other languages, decreasing your risk of costly fines.

Consider these opportunities to eliminate language barriers for Hispanic American homebuyers:

Interpretation services

Interpretation services

Inviting a remote interpreter to join calls or meetings with LEP homebuyers can make your job easier throughout the loan origination process, especially when it comes to meeting deadlines. For example, CyraCom interpretation services include:

- Qualified interpreters trained to understand common vocabulary and terms related to loans, including mortgages, helping you communicate quickly and effectively.

- Transparent per-minute pricing, ensuring you only pay for the minutes spent with an interpreter on the line.

- Dedicated account management and 24/7 client support services available to help your team whenever they have a question.

Translation services

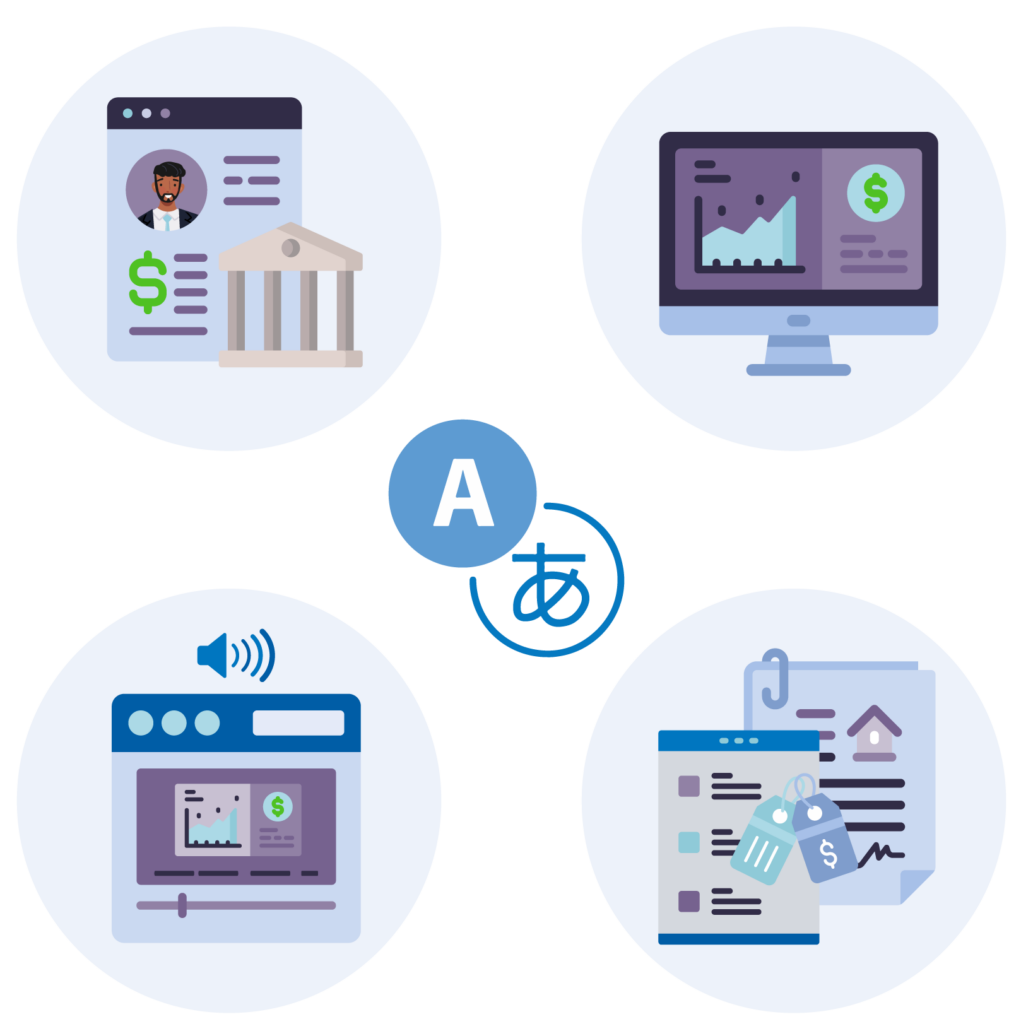

Translating written information into Spanish and other top languages in your community helps your LEP homebuyers better understand your processes and the terms of their loans. We recommend translating content such as:

- Loan applications and informational materials

- Website and loan app content

- Video subtitles or voiceovers

- Marketing campaigns and promotional materials

Want a free language services consultation?

Contact CyraCom’s helpful language services experts to learn more about improving the homebuying experience for Hispanic Americans and other LEP clients.